What is Credit Rating?

The most general meaning of ‘a credit rating’ is an opinion about an organisation or person’s ability to fulfil their financial obligations based on their previous dealings. The term credit score or a symbolic credit rating refers to a detailed and a quantifiable assessment leading to an estimation of any entity’s general creditworthiness with regard to their financial obligations such as any debt or loan they have. This entity can be any company, business, country, economy, regional authority or an individual.

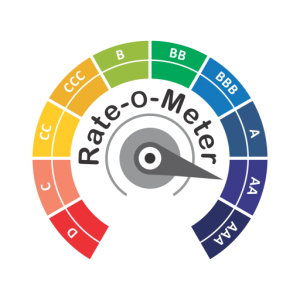

For example, more often a debt is a contract or a loan agreement. A credit rating suggest the likelihood that the borrower who has taken any debt or loan will be able to payback within the agreed terms without any default, modification or delay; and hence, this indicates a possibility of getting debt and/or loan approved by entity who is funding or providing a credit line. A higher credit score or credit rating suggest a lower probability of default or less risky as an investment by an entity and a lower credit score/rating vice-versa scenario.

For example, more often a debt is a contract or a loan agreement. A credit rating suggest the likelihood that the borrower who has taken any debt or loan will be able to payback within the agreed terms without any default, modification or delay; and hence, this indicates a possibility of getting debt and/or loan approved by entity who is funding or providing a credit line. A higher credit score or credit rating suggest a lower probability of default or less risky as an investment by an entity and a lower credit score/rating vice-versa scenario.

This Rate-O-Meter ® app is about deriving a credit score or credit rating of any company, business, firm, organisation or corporate as you name it. And it is not for any individual or person’s credit score or rating.